For example, you can buy an annuity that requires a single upfront payment, or a series of payments to the insurance company. Then, the insurance company pays you either one lump-sum or multiple payments if the insurance pays out. For example, if an individual could earn a 5% return by investing in a high-quality corporate bond, they might use a 5% discount rate when calculating the present value of an annuity. The smallest discount rate used in these calculations is the risk-free rate of return. Treasury bonds are generally considered to be the closest thing to a risk-free investment, so their return is often used for this purpose.

Net present value (NPV) and internal rate of return (IRR)

- What’s more, you can analyze the result by following the progress of balances in the dynamic chart or the annuity table.

- Present value calculations can also be used to compare the relative value of different annuity options, such as annuities with different payment amounts or different payment schedules.

- Present value of an annuity is a time value of money formula used for measuring the current value of a future series of equal cash flows.

- The two most popular uses are for calculating loan payments and for calculating retirement funding needs.

Over the course of the loan, she would pay $934.13 every month for 60 months. Note that my expertise is in creating online calculators, not necessarily in all of the subject areas they cover. While I do research each calculator’s subject prior to creating and upgrading them, because I don’t work in those fields on a regular basis, I eventually forget what I learned during my research.

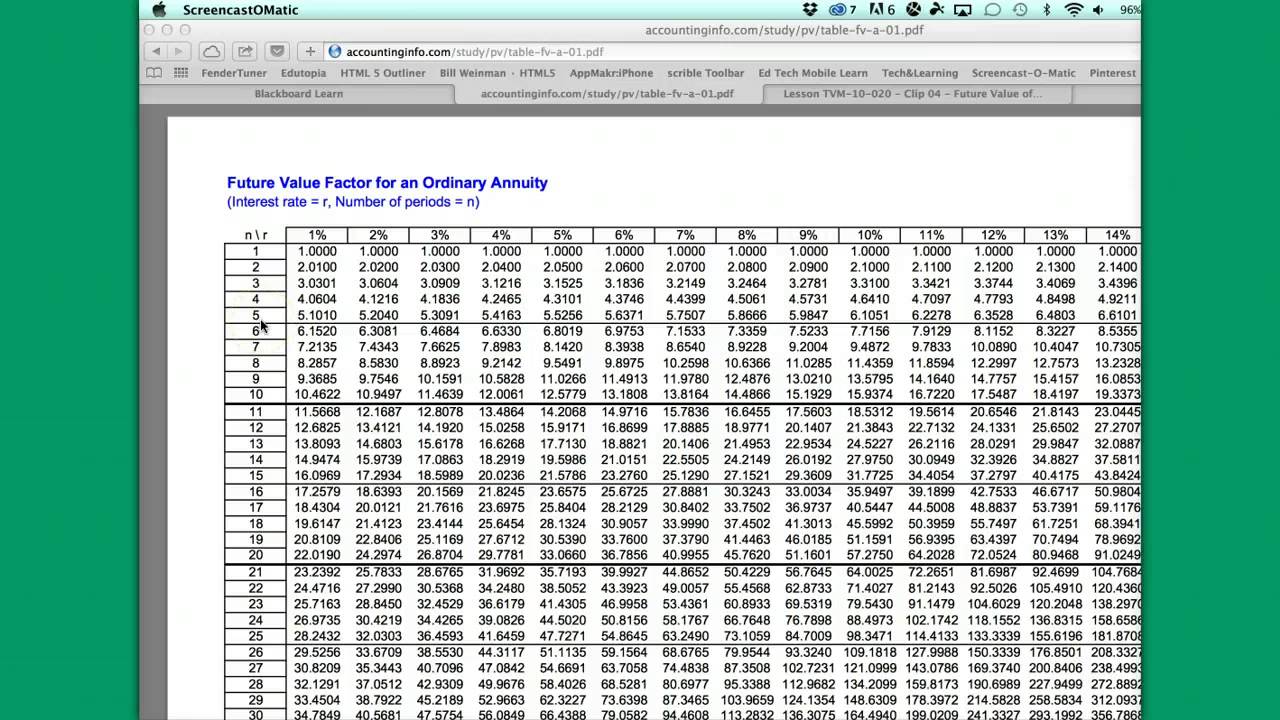

Calculating the Future Value of an Ordinary Annuity

You can also follow the progress of your annuity balance in a dynamic chart and annuity table of the payment schedule. If you would like to learn more about annuities, check our time value of money calculator or the annuity payout calculator. Because of the time value of money, money received today is worth more than the same amount of money in the future because it can be invested in the meantime. By the same logic, $5,000 received today is worth more than the same amount spread over five annual installments of $1,000 each. When calculating the present value of an annuity payment, a specific formula is used, based on the three assumptions above.

Present Value of Periodical Deposits

For example, present value is used extensively when planning for an early retirement because you’ll need to calculate future income and expenses. You must always think about future money in present value terms so that you avoid unrealistic optimism and can make apples-to-apples comparisons between investment alternatives. The net present value calculates your preference for money today over money in the future because inflation decreases your purchasing power over time.

Present Value of a Growing Annuity (g ≠ i) and Continuous Compounding (m → ∞)

NPV is often used in company valuation – check out the discounted cash flow calculator for more details. Because there are two types of annuities (ordinary annuity and annuity due), there are two ways to calculate present value. You can solve for all four variables involved in present value of annuity calculation viz. Unlike spreadsheets and financial calculator models, there is no convention of using negative numbers. Enter only positive values in this present value of annuity calculator.

Present Value Formula

Something to keep in mind when determining an annuity’s present value is a concept called “time value of money.” With this concept, a sum of money is worth more now than in the future. By taking the time to calculate the present value of an annuity, you can decide whether or not investing in an annuity will be in your financial best interest. For example, once the time value of money (TVM) is accounted for, you can see whether it makes sense to allocate your money to a different type of financial asset or to annuities. Calculate the present value of an annuity by entering the payment, term, rate, and type of annuity in the calculator below. You should consider the annuity calculator as a model for financial approximation.

The formula figures the present value of each of the $1,000 payments and discounts them using the 5% interest rate. It then sums up all the present values to arrive at the present value amount. There are multiple types, including those that pay out at a standard rate in the future, along with those whose values might be affected by general changes in the market. They are often used to supplement 401(ks), IRAs, and other retirement savings vehicles. When you set all the required parameters, you will immediately see the results summarized in a table.

The only way Mr. Cash will agree to the amount he receives is if these two future values are equal. The present value of an annuity is the amount of money we would need now in order to be able to make the payments in the annuity in the future. In other words, the present value is the value now of a future stream of payments. This will display the present value of the annuity, the total payments/withdrawals, the interest earned or paid, and a year-by-year annuity chart. The net present value calculator is easy to use and the results can be easily customized to fit your needs. You can adjust the discount rate to reflect risks and other factors affecting the value of your investments.

The best way to demonstrate the strengths of the annuity calculator is to take some annuity examples. In this case, the person should choose the annuity due option because it is worth $27,518 more than the $650,000 lump sum. For a present value of $1000 to be paid one year from the initial investment, at an interest rate of five percent, the initial investment will meghan markle and prince harry’s second child have dual citizenship would need to be $952.38. Although this approach may seem straightforward, the calculation may become burdensome if the annuity involves an extended interval. Besides, there may be other factors to be considered that further obscure the computation. If you read on, you can study how to employ our present value annuity calculator to such complicated problems.